[{"pkid":"116932851","name":"509129897TTS1.WAV","ttstype":"1","url":"https://snap.windin.com/news/OriFile/NewsTTS/202009/0417/1-509129897"},{"pkid":"116932852","name":"509129897TTS3.WAV","ttstype":"3","url":"https://snap.windin.com/news/OriFile/NewsTTS/202009/0417/3-509129897"},{"pkid":"116932853","name":"509129897TTS2.WAV","ttstype":"2","url":"https://snap.windin.com/news/OriFile/NewsTTS/202009/0417/2-509129897"}]

Hong Kong Wind News Agency reported that the United States stock market retreated sharply from historical highs on September 3, and large technology stocks led the decline. Earlier, some warnings about “prosperity and decline” on the market seemed to have become reality. It is worth noting that prior to the arrival of this round of decline, United States corporate executives sold their own Company capital stock certificates last month, the largest scale in nearly five years.

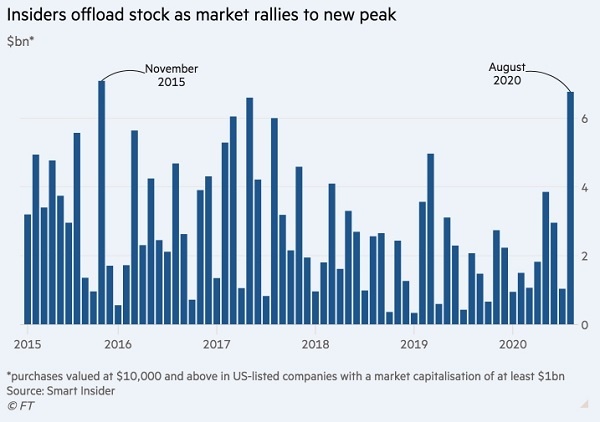

According to data compiled by data provider Smart Insider for the United Kingdom "financial Times", 1042 United States companies’ Chief Executive Officer, Chief Financial Officer and Company Director sold 6.7 billion US dollars of their own Company capital stock certificates in August, and the sales volume exceeded In any month since November 2015, the number of people was the highest since August 2018. These transactions indicate that corporate insiders have realized the historic rebound in US stocks since the March low.

These data cover the sell-off of capital stock certificates with a market value of at least US$1 billion and a reduction of at least US$10,000 in capital stock certificates. The data is based on documents submitted to the United States securities regulator and does not include sales for tax purposes through the Executive Compensation program.

The situation of corporate executives, large shareholders and other insiders buying and selling capital stock certificates will be used as confidence indicators by investors. The high-level sell-off is often considered an ominous sign of these capital stock certificates because they know themselves better than ordinary investors. The trend of stock prices.

Max Gokhman, director of Pacific Life Fund Advisors asset allocation, said: "Compared with investors, Chief Executive Officers have a much pessimistic outlook on the prospects. If you think your (Company) prospects are bleak, but the stock price is soaring, you should sell. Up."

Prior to this, corporate insiders had scrambled to buy bottom U.S. stocks in March and April. However, the August sell-off did not include the capital stock certificates that executives and directors bought in these months because they must hold the capital stock certificates for at least six months, Smart Insider partner Bill Lattimer pointed out.

United States industry Group Danaher Founder Steven Rales and his brother Mitchell became the largest sellers in August. They sold the capital stock certificate of Technology Company Fortive Group worth nearly 1 billion US dollars. Danaher Strip it out. Fortive The stock price has risen by nearly three-quarters since its March low.

In response to this, the super-rich in United States recently increased their cash allocation ratio to a historical high. According to a report by Market Watch last week, Tiger 21, which provides peer-to-peer learning The internet for high-net-worth investors, pointed out that the differences between Wall Street and general business market conditions caused great concern to its members, and they therefore adopted a defensive stance and kept large amounts of cash. However, the Chairman of the agency said that holding cash is to protect oneself from downside risks on the one hand, and on the other hand to prepare for a precise attack when investment opportunities come.

Nasdaq Company insiders' cash out scale doubles

Another data from Broker Company StoneX shows that in the second quarter of this year, the sales volume of the Nasdaq 100 index, which is dominated by technology stocks, into Stock Split Company insiders reached 10.4 billion US dollars, an increase of 171% over the same period last year.

Vincent Deluard, Rafael Micro strategist at StoneX, said: "The insiders of the Nasdaq 100 Index Company are harvesting the once-in-a-lifetime Fortune."

For these stockholders, they are lucky to be safe before the US stock market crash yesterday.

On September 3, the United States stock market experienced selling pressure brought about by profit taking. The three major stock indexes fell sharply, setting the biggest one-day decline since June. Technology stocks, which have led the rise of US stocks in the past few months, generally fell. APPLE The market value evaporated by USD 179.92 billion, setting the United States Public Company's largest single-day market value loss since record.

David Lefkowitz, head of UBS global wealth management capital stock certificate in the Americas, said that large technology stocks have seen some of the biggest bubbles in valuation expansion.

In view of the worst decline in United States economic in decades and the continued raging COVID-19 epidemic, some analysts believe that the strong rally of U.S. stocks is decoupled from fundamentals, and investor sentiment has reached an extremely greedy state, a correction will happen sooner or later, and Proper Xiuzheng is also beneficial to the stock market.

CNN's "Fear and Greed Index" 3Daily Report 58 (in the field of greed), and the previous day was in the field of extreme greed (77). In addition, the volume of Put Options in the past five trading days was 64.9% lower than that of Call Options, indicating that investors continued to bet more, and Put Options' buying volume hit a two-year low.

Holly MacDonald, head of investment at Bessemer Trust, said that yesterday’s sell-off meant that the market had returned to a more normal state to some extent. Considering the strong performance of the stock market in August, this is not entirely unexpected. She expects that volatility will increase after the fall. Increase.