[{"pkid":"140546885","name":"532774813TTS2.WAV","ttstype":"2","url":"https://snap.windin.com/news/OriFile/NewsTTS/202107/2207/2-532774813"},{"pkid":"140547050","name":"532774813TTS1.WAV","ttstype":"1","url":"https://snap.windin.com/news/OriFile/NewsTTS/202107/2207/1-532774813"},{"pkid":"140547051","name":"532774813TTS3.WAV","ttstype":"3","url":"https://snap.windin.com/news/OriFile/NewsTTS/202107/2207/3-532774813"}]

Hong Kong's Wande news agency reported that as the virus mutation caused investors to worry about economic growth, the investment bank report's judgment on the future also diverged. In recent days, Goldman Sachs Contrary to the previous bull position, analysts suggest that investors will further pull back in the next few weeks, and the market will meet multiple "catalysts" in August.

Specifically, Goldman Sachs Trader Scott Rubner's report explains his expectations for the market's correction in August from several perspectives, including cash flow, accelerated selling by sellers, and investment from investors Goldman Sachs Feedback from the stock exchange hall. Goldman Sachs The investment bank believes that the recent rebound in the US stock market is only "selling at high prices", which is opposite to "buying at low prices". The investment bank does not recommend investors to "enter" in the next rebound.

1. August is the off-season for stock trading. Goldman Sachs It points out that the seasonal factors in August are not favorable to the market. Judging from the historical data, the US stock market shows a downward trend throughout August, which is the fourth bad two-week seasonal period in a year. Since 1950, in 72 years, S & P 500 The index rose more than 10% in the first half of the year 19 times. Specifically, after strong market performance in the first half of the year,The median rate of return in August usually falls by 51 basis points and then rises。

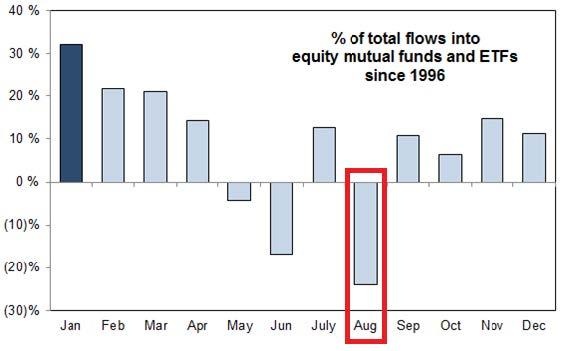

2. U.S. stock capital inflow is expected to reverse in August——Stock inflows were not common in August. In the past 30 years, August is usually the month with the most capital outflow in a year。 Goldman Sachs Due to the outflow of funds, US stocks are expected to be sold in August with a value of US $33 billion.

(photo source: Goldman Sachs )

Goldman Sachs It is further pointed out that 33 billion US dollars is not a large number after market value adjustment. But more importantly, the US stock index is at its highest level over the years because the previous capital inflow has pushed up the index heavyweights with the largest market value. Monday, Goldman Sachs It is unusual to see a serious imbalance in the closing market order (MOC) for sale.

3. Passive capital flow is driving the biggest market value stocks up - in the first half of this year alone, passive ETFs set the best annual capital inflow record on record. What if this dynamic disappears? Prior to the inflow of funds more concentrated in the head of the market value of stocks, as well as Nasdaq 100 Index ETF and other passive funds will be hit hard. Then, investors need to decide which industry will be the main source of capital outflow.

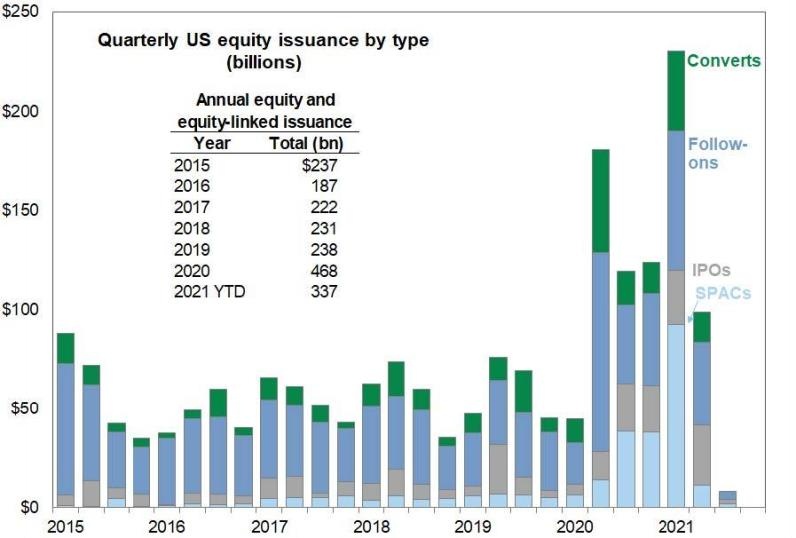

4. Stock issue. Goldman Sachs It is pointed out that although corporate profits promote repurchase expectations, the growth of stock issuance will offset this favorable factor. Last week's stock issuance was $6.2 billion, compared with an average of $3.4 billion in July since 2000; There were 27 stock exchanges last week, compared with an average of 15 a week since 2000.

(photo source: Goldman Sachs )

Goldman Sachs In conclusion,The dynamic change of market capital structure in August is remarkable. The investment bank expects the market to fall 5% and investors can buy later in the Jackson Hole seminar。 Some investors expect a larger adjustment in the stock market, taking into account the size of capital in the financial system, Goldman Sachs I don't think that will happen. Considering that funds are highly concentrated in several stocks and passive funds, once the outflow of funds in August really occurs, technology stocks will lose out on cyclical stocks.

Goldman Sachs Warning that once we see the first outflow of funds in August, it will be a macro trigger for Tactical Short. Investors need to be vigilant and pay close attention to market liquidity.

Goldman Sachs It's not the only investment bank that has hinted at the risk of August. 'although the downward pressure on the stock market is fleeting, it doesn't necessarily mean the end of this summer's market volatility,' Ryan Detrick, chief market strategist at LPL financial, said in a report on Wednesday.

"From less stock participation, to weaker seasonality, to a lack of bear market, to volatility in a typical two-year bull market, the summer months may be the correction time for a final correction (down 5-9%) or even 10%," Mr. Detrick wrote

That's why, after rising more than 90%, he thinks S & P 500 index One of the "many reasons" for "finally being able to prepare for a pullback," especially in the usually difficult months of August and September.Since 1950, S & P 500 index The average monthly returns in August and September are basically negative in different periods.

"It's incredible that we haven't seen a 5 per cent correction since last October," Mr Detrick said He also pointed out that since 1950, S & P 500 index On average, there are three pullbacks of 5% or more per year, and "not once in 2021."

"This does not mean that a 5% adjustment is coming, but it should be noted that most stocks have actually fallen by as much as 10% from recent highs, which indicates that the market is slightly weak and the risk is higher than normal."